The acquisition of Scitex Vision by HP in 2005 resulted in the creation of the Israel-based, HP Scitex division. The division is now developing a novel digital printing press for the corrugated packaging market. General Manager, David Tomer: “We discovered a multi-billion market, which is still fully analog”

In contrast to its public image in Israel, the well-known Scitex brand has not disappeared. It is now operating under HP’s thick cover, far from public attention. The company is on the threshold of a technological revolution which could completely change the multi-billion corrugated packaging printing market. Techtime recently met David Tomer, the head of an advanced HP research and development center In Israel, HP Scitex, which is part of HP’s Imaging & Printing Solutions business.

The group employs some 500 employees in its various sites across Israel, including its headquarters in Netanya, hardware manufacturing plant in Caesarea and inks manufacturing plant in Kiryat-Gat. HP Scitex plans to bring to market its new innovative digital corrugated packaging system. Tomer: “We discovered a multi-billion market, which, to our amazement, is still fully analog. The packaging market still relies on traditional Offset and Flexo technologies”.

According to Tomer, the printing market’s new focus is packaging. “This was one of the main themes at Drupa (the leading Print exhibition worldwide, held in Germany) three months ago. The market demands short runs, high versatility, reliability and an extremely fast response time. A typical Supermarket in the US carries some 48,000 products. The customers make decisions in a matter of seconds. Packages have to be fetching, they need to be interesting, unique. To cope with this challenge, we developed the new HP PageWide C500 Press, which will reach the Alpha stage at a customer site this year. We expect to be able to distribute it commercially as soon as 2017. I am proud that this is a project led from Israel, from top to bottom: from technological development, to production and assembly of the machines, and finally to delivery to customers worldwide – all of these take place in Israel”.

What is the technological depth of the project?

omer: “Development began in 2014. It is based on a series of technologies developed specifically to handle the unique problems associated with the world of corrugated packaging. One has to keep in mind, that corrugated boards are an uneven media, which led us to develop a specialized gripping technology called CorruGrip. This technology manages to handle any board, no matter how warped it may be, making it possible to bring the print-heads very close to the media”.

“Another challenge was the development of the ink. In the packaging world, ink has to be water-based, because the more commonly used UV ink is not cleared by the FDA for food packaging purposes. Food packages make up 30% of the global packaging market. Our ink formulas are kept as confidential as the famous Coca-Cola formula”.

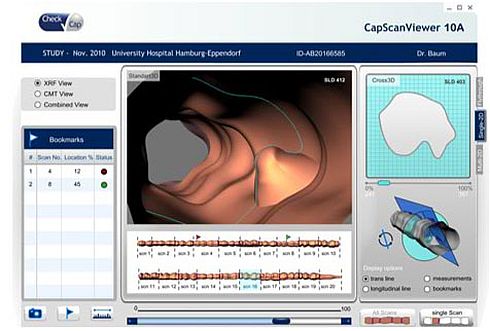

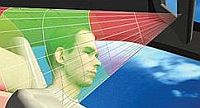

The ink injection method developed is based on HP’s PageWide technology. In this technology. Thermal inkjets are mounted across the beam, which hovers over the printing surface. By using multiple beams, all the required shades can be produced. The accuracy is measured by the numbers of nozzles across the beam – in HP Scitex’s case, 1 million nozzles. The new system is extremely fast, but its exact speed is still kept confidential. When the system is distributed, it will be managed through HP’s cloud-based PrintOS system.

In which stage are you now, are there customers for the new system?

“We already have several customers waiting for the new system. We created a group of chosen customers called the Corrugated Packaging Advisory Council, which includes seven of our top customers. We meet them every few months, showing them our progress and discussing relevant issues. They take part in the development process, and they will be the first to receive the HP PageWide C500 Press when it comes to the market”.

The only company which HP chose to disclose as a C500 customer is Smurfit Kappa Group. “This is the leading corrugated packaging company in Europe, with over 100 corrugated converter factories. A year before the printer will be available, they already decided, that it is the best solution for them”.

What is the scope of HP Scitex?

Since the acquisition by HP, we have built up an Israeli operation which develops, produces and sells large format presses worldwide. We focus on commercial printers sold for a $0.5-$1.5 million a unit. Currently we have an installed base of over 2,400 presses – all of which were developed and produced in Israel.”

Motorola Solutions Venture Capital has invested in

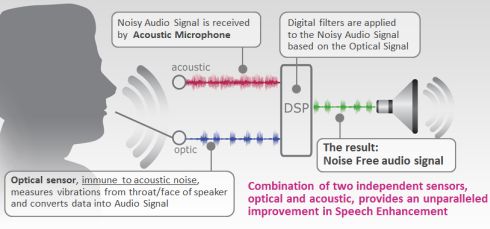

Motorola Solutions Venture Capital has invested in  VocalZoom was founded in 2009 by the CEO Tal Bakish, former HW engineer in companies such as Cisco Systems, IBM, Modu-Mobile, ConnectOne and Intel. While conventional approaches focus on filtering and signal processing to isolate the voice from ambient noise, VocalZoom is applying its patented technology that integrates a standard acoustic microphone and a special optical sensor to solely detect the speaker’s voice.

VocalZoom was founded in 2009 by the CEO Tal Bakish, former HW engineer in companies such as Cisco Systems, IBM, Modu-Mobile, ConnectOne and Intel. While conventional approaches focus on filtering and signal processing to isolate the voice from ambient noise, VocalZoom is applying its patented technology that integrates a standard acoustic microphone and a special optical sensor to solely detect the speaker’s voice.