[Photo: A Markforged printer. Source: Markforged]

By Yochai Schweiger

During Nano Dimension’s earnings call last Thursday, following the publication of its Q3 2025 results, the company’s new CEO, David Stehlin, mentioned the name Nano Dimension exactly once — in the formal opening line. From that moment on, the discussion revolved almost exclusively around the commercial activity and product lines of Markforged, the U.S. 3D-printer manufacturer Nano Dimension acquired and finalized the merger with a few months ago. Flagship FX10 and FX20 printers, the Digital Forge platform, use cases in defense, aerospace, automotive and industrial sectors — these dominated the call, while Nano’s original business disappeared almost entirely from the agenda.

The absence of any reference to Nano’s historical core operations stood out sharply. Its 3D printed-electronics technology, the DragonFly printer, and the broader focus on additive electronics — all central to the company’s identity for years — were not mentioned once.

In its early years, Nano Dimension issued press releases for nearly every DragonFly sale. But for several years now it has not announced any such deals, and the brand that once represented its technological edge has effectively vanished. Sales volumes in that legacy business can now be inferred only indirectly. After the Markforged acquisition, the company even changed its business description from “additive manufacturing of advanced electronics” to “digital manufacturing solutions.” Earlier in 2024, Nano Dimension also carried out a substantial workforce reduction in Israel.

Control Shifts From Nano Dimension to Markforged

This transition is visible not only in the narrative but also in senior leadership. Management gravity has shifted outward from Israel, and control appears to have moved from Nano’s leadership to Markforged’s.

Stehlin, the new CEO, comes from the telecom sector rather than the 3D-printing industry. His appointment surprised investors, as he replaced Ofir Baharav — a veteran of Israel’s additive-manufacturing sector via XJet — who was dismissed after just a few months in the role. Financial leadership has similarly shifted: Nano’s CFO, Assaf Zipori, has departed and was replaced by Markforged’s CFO, John Brenton.

A Loss-Making Company Taps Into Nano Dimension’s Cash Pile

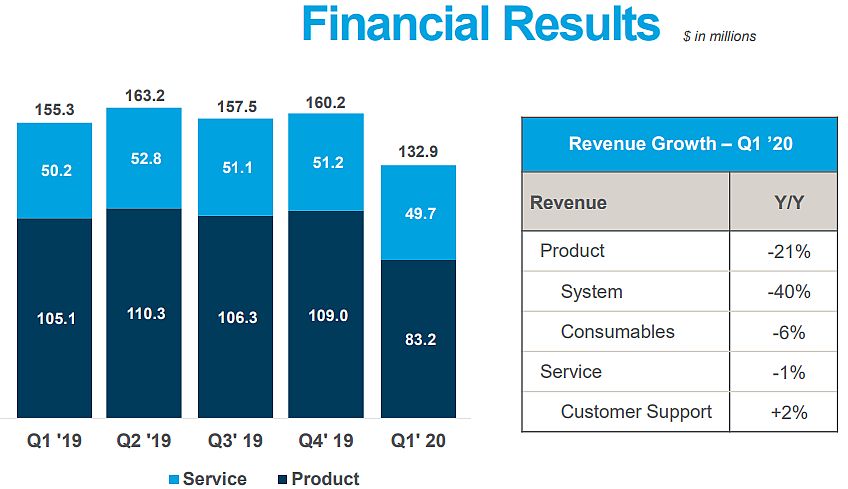

Nano Dimension acquired Markforged in April 2025 for approximately $116 million. Founded in 2013 and based in Waltham, Massachusetts, Markforged employs several hundred people and specializes in industrial 3D printing of metals and composites for aerospace, automotive and industrial equipment sectors. In 2024 it generated $85.1 million in revenue but posted a net loss of $85.6 million, weighed down by $127.7 million in operating expenses.

The merger — combining a larger, higher-revenue but deeply loss-making Markforged with the smaller but cash-rich Nano Dimension — has effectively created a new company. This is clearly reflected in the financial structure shown in the first report of the combined entity: revenues surged, but profitability deteriorated sharply.

The numbers are stark. Q3 revenue jumped to $26.9 million — up 81% year-over-year — but $17.5 million of that came from Markforged. Without the acquisition, Nano’s legacy revenue dropped to just $9.4 million, a 37% decline. The message is clear: nearly all growth is coming from the acquired business, while printed-electronics revenues have shrunk to a secondary segment.

As a consequence, adjusted gross margin eroded from 50.5% to 47.4%. Unadjusted gross margin — which includes inventory charges, integration costs and accounting impacts related to the Markforged deal — fell far more sharply, from 48% to around 30%, signaling heavy one-time (and likely multiquarter) burdens.

Bottom line: if Nano Dimension lost $9.9 million in Q3 2024, the latest quarter ended with a net loss of $29.5 million. With Markforged now consolidated, Nano has also added more than $100 million in annual fixed operating expenses. Quarterly operating costs surged to roughly $29.2 million, an increase of $8–10 million per quarter versus Nano’s pre-merger expense profile.

From Markforged’s perspective, the deal is close to ideal. The company is now housed inside a cash-rich entity holding more than half a billion dollars — financial oxygen it lacked as a standalone business. Markforged has effectively joined a firm capable of funding its loss trajectory and long investment cycles, giving its product roadmap a significantly more stable foundation.

The 3D-Printing Industry’s Vicious Circle

Viewed in a broader context, the Nano–Markforged merger mirrors a familiar pattern in the 3D-printing sector. For more than a decade, the industry has oscillated between sky-high expectations and slow-moving commercial reality: expensive R&D, long sales cycles for industrial customers, and the need for heavy service and sales infrastructures. Many companies attempted to solve the problem through acquisitions — stitching together broader “platforms” in hopes of achieving operational scale and technological synergy. In practice, these moves often produced integration challenges, cost inflation and financial structures mismatched to market size.

Nano Dimension launched its acquisition strategy in 2022 after raising roughly $1 billion in cash, becoming one of the most capital-rich players in the space. Over the next two years it acquired five to six companies in 3D printing and electronic manufacturing. Most of these efforts ultimately failed: in recent quarters, Nano has shut down or significantly downsized most of the acquired operations. The clearest example is Desktop Metal — a deal in which Nano bore part of the cost burden — which ended in bankruptcy and was classified as a discontinued operation. Against this backdrop, Markforged seemed like the more sensible acquisition: a larger company with meaningful revenue and a global customer base. Yet the latest results show that Markforged also brings with it the industry’s characteristic traits: chronic unprofitability and heavy cost structures.

Nano Dimension had hoped to be the company that breaks this cycle — leveraging its cash reserves and its unique printed-electronics technology to reach profitability where many competitors failed. But judging from the latest report and the accompanying earnings call, the company is now in a transition period in which its historical core is shrinking, the acquired business dominates, and the organizational identity is shifting.

The process is still unfolding — but the question already hangs in the air:

Did Nano Dimension acquire Markforged, or has the acquired company become so dominant that it’s no longer clear who actually absorbed whom?