DSPG Warns Its Shareholders from a “fight for control” by Starboard Value

10 March, 2013

The chairman and the CEO wrote to the shareholders that "Starboard Value, which owns approximately 10% of the company's shares, has threatened the company with a proxy fight for control of the board unless its demands are met. Starboard is also demanding that DSP Group put itself up for a quick sale"

Tessera Technologies from San Jose, California, is currently engaged in an identical struggle with Starboard

After a break of almost a year, a new power struggle between DSPG management and the investment firm from New-York, Starboard Value, is about to begin. Last year, when After reaching 9.2% of DSPG common shares last year, Starboard initiated a proxy letter to the shareholder demanding control over the company’s board of management, and shifting the corporate strategy away from development of new products. The settlement in April 2012 gave Starboard 2 directors in the board, but left the strategy in the hands of the management.

Now, when the agreement period is about to end, the future of DSPG from Herzliya, Israel is again on stake. Over this background came the letter to the shareholders last week, that was written by Eli Ayalon, Chairman of the Board, and Ofer Elyakim, Chief Executive Officer.

“Starboard Value, a New York-based investment advisor which owns approximately 10% of the company’s shares, has threatened the company with a proxy fight for control of the board unless its demands are met.”

“There is no need to change the board”

They continued: “Now that the standstill period has expired, Starboard has made demands, which if accepted could effectively give Starboard control of the company, despite Starboard’s ownership of only approximately 10% of the company’s stock. Even though Starboard already has two nominees on your board, Starboard is demanding extra seats on the board, significant representation on all board committees, an effective majority on the compensation committee, which would include half Starboard nominees and a Starboard chairman, as well as the formation of a new strategic committee, which would also include half Starboard nominees and a Starboard chairman. We are confident that our current board is highly experienced, diversified and qualified and that there is no need to change the composition of our board.

“Starboard has also called upon the company to cease work on the development of new products and to focus all of our resources on our legacy technology. We believe this demand shows a lack of understanding of the technology landscape, where companies must innovate or perish. The corporate graveyard is littered with tech companies that failed to improve and develop new products. Starboard is also demanding that DSP Group put itself up for a quick sale, with a focus on short-term returns and undermining shareholder value that would be generated and realized in the mid-term by executing on the existing growth initiatives.

DSPG enter new markets

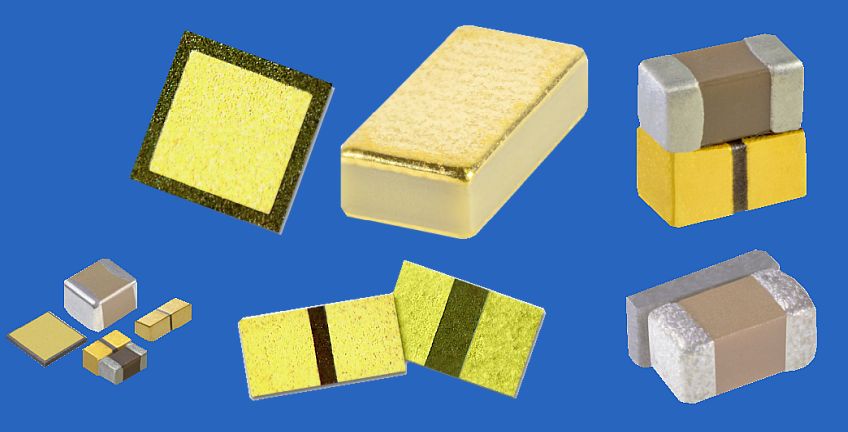

“Up until now, DSP Group’s main focus has been on providing wireless System-on-Chips (SoCs) for cordless DECT phones widely used in homes today, a market where we have a 70% market share. Recently, we expanded into SoCs targeting IP phones for office and businesses. We have quickly moved into third position in this product category, following Texas Instruments and Broadcom, and we are well positioned for strong revenue growth and market share expansion in this segment. Based on market research reports and DSP Group internal estimates, there are approximately 45-50 million IP terminals sold each year and the number of units sold annually is growing in the mid-teens on a percentage basis, as more businesses replace old dual transfer mode phones with new IP based telephony systems.

“On February 25th, we unveiled our revolutionary HDClear solution, a comprehensive voice enhancement product for mobile devices. Incorporating proprietary, groundbreaking noise cancellation algorithms, HDClear dramatically improves user experience and delivers unparalleled voice quality and call intelligibility. This breakthrough technology, which we are very excited about, will enable people to use their cell phones for conversation in virtually any conditions, whether in a car, on a train or in other noisy surroundings. HDClear will also facilitate the use of speech recognition and voice commands by eliminating background noise.

“According to a recent Reuters report, the market research firm International Data Corporation estimates that 63 percent of all mobile units will have technology to eliminate background noise by 2015, or about 1.7 billion units, up from 500 million in 2012. We intend to be a market leader in this category and believe that HDClear will help build our mobile business segment to account for a third of our revenue within three years. We expect noise elimination technology to be increasingly integrated in mid-range smartphones and feature phones — as opposed to just high end phones — as well as smart TVs, game consoles, personal computers and automobiles. All of this, we believe, bodes well for the future growth and profitability of your company.

“we also remain firm that turning control of the company over to a board representing a single shareholder holding only approximately 10% of the company’s outstanding shares, would not be in the best interests of the company, its shareholders or the goal of maximizing shareholder value, especially when you consider that Starboard’s expertise is in investing for short- to medium-term returns and not in the long-term management of a technology company with global operations.”

Tessera alongside DSPG

Techtime has learned that the management is now waiting for Starboard response. This way or another, we stands in the beginning of a bitter fight over the future of DSPG, and it is too early to asses its end. Other companies already felt the heavy hand of starboard. Among them Zoran Semiconductors and MIPS that where sold in low prices. Another company, Tessera Technologies from San Jose, California, is currently engaged in an identical struggle with Starboard.

Posted in: News , Semiconductors , Technology