Uber game: The Autonomous car is a Business Revolution

21 August, 2016

Otto’s acquisition by Uber for $680 million teaches that the autonomous car revolution is focused on autonomy, not on cars: Branding, added value and most of all profits will shift from automotive hardware manufacturers to the new autonomy service providers

Otto’s acquisition by Uber for $680 million teaches that the autonomous car revolution is focused on autonomy, not on cars: Branding, added value and most of all profits will shift from automotive hardware manufacturers to the new autonomy service providers

Roni Lifshits, Editor of Techtime News

Last week, Uber founder and CEO Travis Kalanick announced the acquisition of San Francisco based Otto, for an estimated sum of $680 million. This acquisition is an amazing achievement considering that Otto was founded in February 2016, an infant startup by any account. An examination of the deal, and of Uber’s strategy suggests that behind this deal lies a long term strategy, focused on autonomous transportation business models rather than groundbreaking autonomous driving technology.

Otto was founded by to ex Google engineers: Israeli Lior Ron, former head of Google Maps development section and Anthony Lewandowsky, former leader of google’s self-driving car project. As early as 2004, Lewandowsky was among the developers of the Gohstrider – an autonomous motocycle developed for the Defense Advanced Research Projects Agency (DARPA). In his announcement, Kalanick disclosed that all 90 Otto employees will join Uber following the acquisition.

Using truck to bypass obstacles

Uber and Otto’s actions in the autonomous driving field are surprising and thought provoking. Otto has decided to bypass most of the difficulties bundled with the development of autonomous vehicles, focusing on trucks hauling goods on America’s highways. Otto does not develop and manufacture trucks – it develops and orientation and control kits that can be mounted onto exiting trucks, making these autonomous. Last month, Otto fitted three old Volvo Trucks with a sensor kit including a radar, a LiDAR system and several cameras. The trucks were that launched to roam Navad’s higways driverless.

This strategic decision has several advantages: Long-haul transit accounts to 70% of American cargo traffic, and suffers from a severe shortage in drivers. On the other hand, Highways pose a much simpler challenge for autonomous driving than urban surroundings, in which most companies such as Tesla and Google are focusing.

Long-haul fleets also have a business model that can absorb the additional costs associated with the installation of autonomous driving systems – even in massive numbers. The goal: to supply autonomous trucks by 2021, the year in which autonomous driving is almost unanimously believed to mature, technologically as well as legally. This model actually complies with Uber’s exiting autonomous driving strategy.

A cooperation with Volvo

In late 2015, Uber has established its autonomous driving section, luring most of Carnegie Mellon University’s robotics faculty. Uber’s move also bypassed the autonomous vehicle manufacture problem. Uber has signed a cooperation agreement with Volvo. Volvo was to supply Uber with XC90 cars, on which Uber was to install an autonomy kit, connected to Uber’s application – making these driverless cabs for Uber’s use.

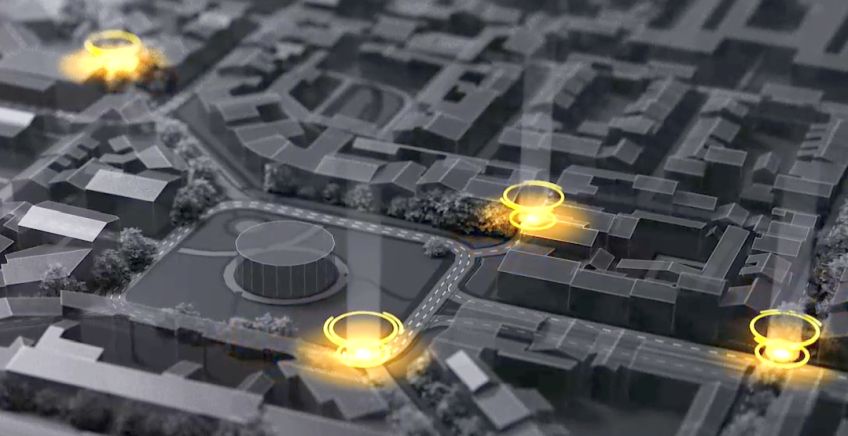

These two moves make clear a crucial point – the autonomous driving revolution is focused on the autonomy, not on the car. The added value if an autonomous vehicle or an autonomous fleet are measured by the degree of autonomy. I.e. navigational systems, reliability, the servicing infrastructure provided by the cloud and so on. The branding will shift from car manufacturers to autonomy service providers.

For companies such as Uber, this is a golden orotundity. Exactly like Google is entering the autonomous driving arena in order to turn its mapping algorithms a new income source, and Amazon is entering the UAV markes in order to enhance its logistical capabilities, Uber has discovered that autonomous driving is opening up a new opportunity for its core business: mobility services.

What’s a “white car”?

The Otto acquisition shows that autonomous driving is creating new business models: through Otto, Uber can become a transportation company supplying service on demand, using an application. It’s similar to supplying new applications using exiting communication infrastructure. In fact, Uber even won’t have to purchase a single truck – it can offer transportation solution providers to install its autonomy kit and join Uber’s pool, thus securing work orders.

One of the interesting questions is the car manufacturer’s response to these developments. The trends led by companies such as Uber might force them to establish new service companies supplying autonomy services on demand. If traditional car manufacturers fail to do so, they face a real danger that in a few years, most of the cars will become “white boxes”: a standard shelf product, not unlike a PC or a server, sold according to its value, and not according to the brand’s added value.

Posted in: Automotive , Business , Featured Stories , News