Digital power advances the reliability, manageability, flexibility and time-to-market of isolated DC/DC converter powered systems

A. Russell, Calex

Digital power control and power management has established itself as a mature technology in Point-of-load (POL) applications over the last several years. It has already passed the adoption inflection point in higher-end applications such as servers, computing and networking.

Digital power in POL applications has shown to be valuable in dynamic adjustment of output voltage, optimization of the control loop operating point and parametric monitoring of the local power delivery for enhanced system reliability and efficiency.

In this article we shall discuss how the benefits of digital power can be extended to applications powered by front-end DC/DC converters and propose how it can improve reliability, manageability, flexibility and time-to-market of DC/DC powered systems.

DC/DC Vs POL

POL converters have largely transitioned away from power modules to ‘down solutions’ (i.e. built directly on the customer mother board). This transition was possible due to relative simplicity of the power conversion stage, which is almost exclusively a Buck Converter, requiring, for a single phase application, 2 switches, a simple L-C filter and the driver and controller IC.

DC/DC converters however have resisted the transition to down solutions due to the higher complexity of the power conversion function. Modern high density DC/DC converters require planar-magnetics, driving PCB technology (up to 20 layers) include a transformer isolation stage, thermal management and heat-sinking, have much more complex synchronous rectification stages, require operation from very wide unregulated source voltages (e.g. 4:1 input) and except for the simplest of applications.

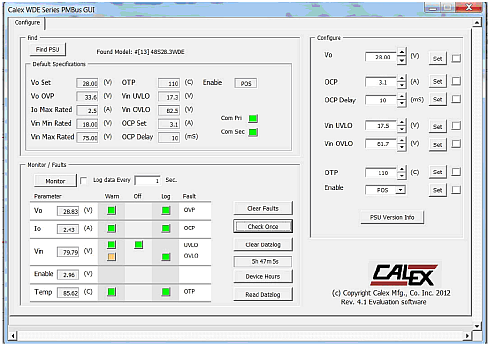

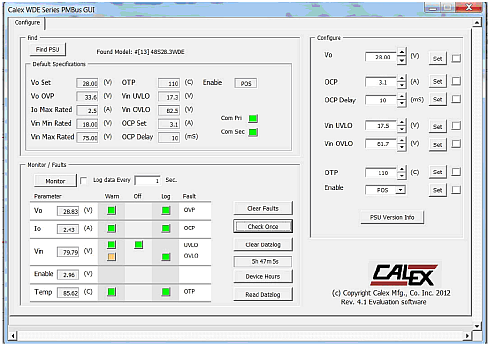

Digital Management GUI

Digital Management GUI

Reliability

The first order stress factors for DC/DC converters in terms of reliability are Input Voltage (Vi), Output Current (Io), Operating temperature (T) and component count. Knowing what conditions existed immediately prior to system failure so that appropriate steps can be taken to prevent a reoccurrence in future.

Input Voltage (Vi)

Implementing digital power management of the input voltage can have a number of benefits. For example DC/DC converters in high reliability applications often feature 4:1 input ranges, primarily to allow a single version of equipment to be connected to a number of input sources, such as 12, 24, 48V batteries. The system reliability could be further enhanced if the input voltage range (under-voltage and over -voltage) were re-configured to be appropriate to the voltage applied in the application where operation outside of this range would indicate a system fault.

Furthermore, digital management of the input voltage allows more precision in the timing of an over-voltage condition. A converter may be rated for a short duration absolute-maximum voltage but a digitally monitored input voltage can take more appropriate action in events such as warning the system of forcing a shut-down once absolute-maximum duration is exceeded.

Output Current (Io)

DC/DC converters are provided in various power ratings to economically cover the broad market. Inevitably the actual power / current rating is rarely ideal for the actual application. Implementing digital power management of the current / current limit function can have a number of benefits for the customers system.

The actual current consumption of the system can be monitored during design evaluation testing. The customer can then set the current limit more appropriately in the design or set a warning level to indicate when the system is operating beyond its characterization envelope.

Operating Temperature (T)

DC/DC converters to date may have featured a crude over-temperature protection at a very high inception point to invoke a sudden shut-down, purely for the converter to protect itself (selfishly) with no consideration for the downstream impact on the broader system.

With digital quantization of the temperature variable there are a number of options available to increase system reliability and up-time. Temperature is a critical parameter in MTBF. It is a generally accepted heuristic that reliability is halved for every 10oC increase in temperature.

Component Count

Reduction of 20% in component count further improving reliability pro-rata.

Black-Box Recording

One of the greatest reliability benefits of a digitally enabled DC/DC converter is its ability to maintain an internal data-log of previous fault conditions experienced and in particular the status of the key variables immediately prior to a catastrophic failure event.

Today the RMA process of determining failure modes of analog DC/DC converter is in the field of ‘guesswork’.

However with a digital Black-Box recorder – knowing for example that the Vi and Io were within the rated range but the operating temperature was high or exceeded, could indicate that the root cause of the problem was more likely with heat-sink attachment, fan failure or blocked ventilation.

Manageability

The manageability of digital power relates to the ability to be able to monitor critical parameters (Vi, Io, T, Vo) and react in the most appropriate way. These parameters can be monitored as real time values or simply as warning and fault levels. Appropriate management actions may include:

- Communicating fault / warning status to user.

- Adjusting fault levels temporarily (over-current, over temperature, input over-voltage).

- Automatically determining input voltage range on commissioning.

- Adjusting output voltage (which may also be the IBV for improved system efficiency).

- Allowing an over-temperature condition to be sustained for a particular interval.

- Increasing fan-speed / cooling to deal with peak temperature.

- Asserting a flag for an informed service interval based on warnings flagged.

Manageability does require the customer to devote some microprocessor time / hardware to the management of the front-end DC/DC

Flexibility and Time-to-market

A digital power enabled DC/DC converter which is configurable allows the system designer much greater flexibility in the design phase and therefore faster-time to market. Configurability of input voltage range, output voltage, current limit inception point, over temperature protection and warnings, to name but a few are all available at the click of a mouse. Furthermore a digitally enabled DC/DC converter includes the ability of speeding up design validation and debug.

Conclusion

DC/DC converters are a critical front-end components in many industrial, military, transport, mobile and communications applications. When digitally enabled they can capture, act on and log valuable information about the operating environment, battery status, system load conditions, power consumption and fault history. With monitoring and configuration capabilities the system designer can get products to market faster and with a higher level of validation coverage. They enable the DC/DC manufacturer and the system designer to have a higher degree of competence and confidence in the debug of system failures and therefore continuous improvement in the reliability of the end solution.

More information: http://www.calex.com/wdeinfo.html

Contact: Yuval@boran.co.il

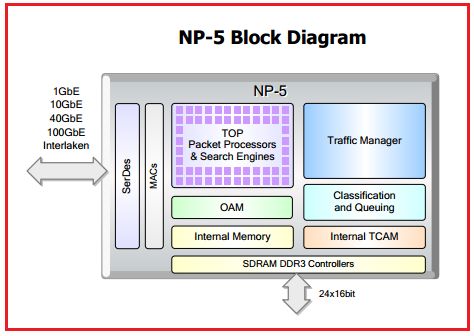

“The largest of EZchip’s router vendor customers are now providing NP-5 based line cards to their customers,” said Eli Fruchter, CEO of EZchip Semiconductor. “We are also well advanced in bringing to market the revolutionary NPS network processor that drives new applications and yet again doubles throughput and opens up new market opportunities for us.

“The largest of EZchip’s router vendor customers are now providing NP-5 based line cards to their customers,” said Eli Fruchter, CEO of EZchip Semiconductor. “We are also well advanced in bringing to market the revolutionary NPS network processor that drives new applications and yet again doubles throughput and opens up new market opportunities for us.