In a conversation with Jon Medved, the driving force behind the OurCrowd capital raising and investment platform, it’s clear that he is deeply involved in the war effort. “This generation is unlike any other in terms of courage and dedication. Our children are on the front lines, and our role is to safeguard the economy.” Born in the United States, Medved communicates the Israeli story to leading global media outlets and maintains daily and close contact with venture capital firms and international partners to show them how the Israeli industry continues to operate and expand even during wartime.

In an interview with Techtime, he explains that the response in the financial world is very positive and discusses his anticipation of renewed growth in the Israeli tech industry after “the victory and the end of the war.” Medved noted, “War is always a bad sign for investments. When the cannons roar, investors do not sign checks. But if you look at the Israeli economy over the past 25 years, you’ll see that after every war, there is an increase in investment volume. Wars do not deter the overall growth of Israel’s gross domestic product. This is also evident in the Tel Aviv Stock Exchange data: sharp declines when the war breaks out, followed by a significant upswing when it ends.”

Private Investors in the Masses

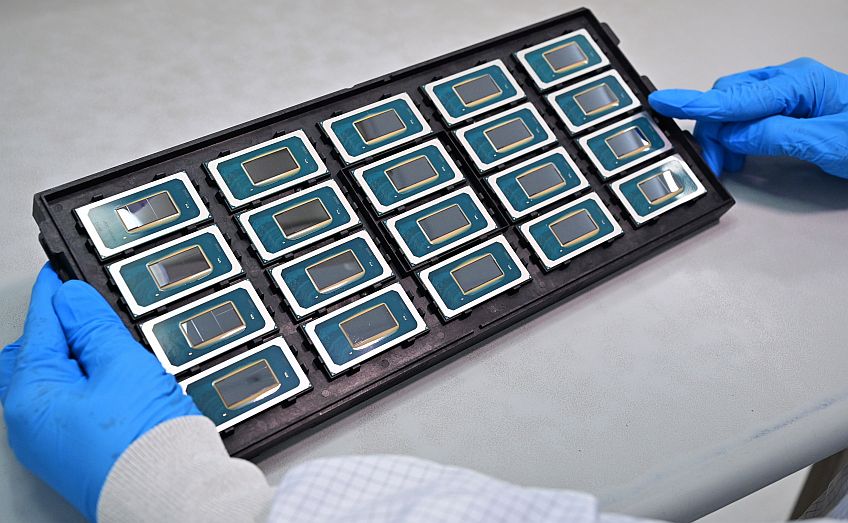

Jon Medved founded the OurCrowd platform in 2013, and it has become one of the prominent investment platforms in the tech sector. Today, it includes over 225,000 registered investors who have invested in approximately 425 companies, with a total investment volume of around $2.2 billion. This platform is considered the most active tech investor in Israel, with 63 successful exits to its name. It has led to investments in numerous electronics companies, such as NeuReality, Hailo, Celeno (which was sold to Renesas), Core Photonics (sold to Samsung), Argus (sold to Continental), and more.

“We built a platform that allows individual investors to select companies for investment after passing a comprehensive review by us and being selected by our investment committee. We also raise capital and investments from our partners (50 international firms like SoftBank, Stifel and Orix). For these investments, we invite the masses – currently, there are around quarter of a million investors from 195 countries.” OurCrowd employs about 200 people, with 150 in Israel and the rest in 15 offices worldwide. The platform expanded its activity beyond the Israeli market to global territories, including the United States, the United Kingdom, Spain, Singapore, the United Arab Emirates, and more.

How is the industry responding to the war?

“Everyone is fighting on multiple fronts simultaneously. It starts with employees being called up to the reserves, and companies are dealing with a shortage of human resources. According to our estimates, 10%-20% of the workforce has been called up to the reserves. Those remaining in civilian life work harder and perform many more tasks. Companies need to retain their customers and convince them that they can continue to operate and even develop under wartime constraints. The second front is the investment front, where some companies manage to secure investments and even raise capital. Now, government assistance is coming as well: the Israeli Innovation Authority announced a fund of 400 million shekels, and I believe that this amount will increase significantly.

“We are also engaged in the war effort. We have invested in mPrest, the company that developed the Iron Dome control and command system, in Cyabra, which is making strides in the fight against fake news, and in a company that provides cyber protection for Israel’s electric and water systems. We have companies like UAV developers, an incubator in Kiryat Shmona, and companies operating from Sderot, just one kilometer away from the Gaza border. So, as a company, we are involved in the war effort from all directions.”

The U.S. Government’s Mobilization Sends a Message to the Markets

“We are preparing for a protracted war. The army is preparing the people for a war that will last months, not weeks, and we need to provide our companies with the tools to deal with such a situation. To continue raising capital and benefit from the sense of partnership within the nation. Fortunately, investors respond to our calls and provide support, which I hope will not only continue but also increase. While institutional investors hesitate, there is a massive awakening of entities friendly to Israel. The U.S. government’s mobilization sends a significant message to the markets.

“We have never seen such donation efforts as we are seeing now. A lot of money is coming to Israel from overseas donors. We estimate that significant funding will be directed to academia and hospitals. The tech sector needs to ensure that this awakening reaches it as well. We need to continue channeling funding to companies that are the heart of the tech sector. This heart primarily thrives on foreign capital: 80% of the capital invested in Israeli tech comes from abroad. I believe this will continue. Investors are reaching out to us and asking how they can help.”